Independent Fire Control & Rescue District

TAX ESTIMATOR

|

What's the referendum about?

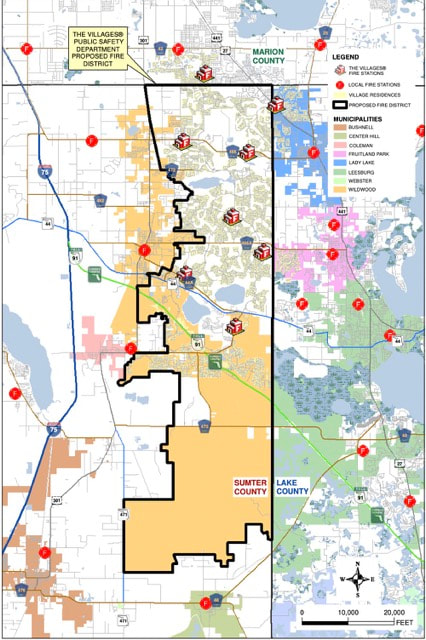

In simple language the referendum is asking voters whether they are willing to pay slightly higher taxes to have their fire, Emergency Medical Service (EMS) and ambulance service controlled by a 5-member Board of District residents, rather than by the Sumter County Commissioners. The language on the ballot is almost incomprehensible, but you can see it HERE. Who votes on the referendum? Property owners who live in the Sumter County portion of The Villages, as well as some adjacent areas. Non-Village Sumter County residents whose fire and EMS service in the past was provided by the Villages Public Safety Department (VPSD) are likely within the District boundaries as well. Non-Village residents can confirm their status by calling Public Safety at (352) 205-8280. |

What You Need To Know

What a Yes-Vote and a No-Vote mean

What is the anticipated tax increase if the referendum passes?

If the referendum passes, the taxes you currently pay to Sumter County for these services, will be paid to the District. As a result, Sumter County's budget will be reduced by an estimated $13 million, so your Sumter Property Tax will go down. The question is: will the reduction in Sumter Property Tax cancel out the amount you will pay the District?

Almost. VPSD estimates the taxes for people living in villas, ranch homes and designer homes will increase by $20 to $100 a year.

Why will they go up at all? If our taxes are simply sent to the District instead of Sumter County, shouldn't we pay the same amount?

That would seem logical, but it's not quite that simple as these nitty-gritty details explain. Warning: The explanation is math-based.

Forget averages! How much will MY taxes increase?

We cannot give you a specific answer because there are two variables that are unknown at this time:

If you provide your best guess to these two unanswered questions along with the Market Value, Taxable Value and Land Value of your home, we will email you the estimated tax increase within 24 hours. Our Best Guess Estimator will do the math for you and we will help you find the information you need.

Rumor Central

The League neither supports nor opposes the referendum. However, we are concerned about misrepresentation of the facts that are circulating and want voters to be aware of the following false or misleading statements. .

To learn the facts, click HERE

- Who makes the decision regarding fire protection, EMS, and ambulance transport service?

- How will fire protection, EMS and ambulance transport service be funded?

- If I pay the District for Fire, EMS and ambulance service, will my Sumter Country taxes decrease proportionately?

- What entity will provide ambulance transport service?

What is the anticipated tax increase if the referendum passes?

If the referendum passes, the taxes you currently pay to Sumter County for these services, will be paid to the District. As a result, Sumter County's budget will be reduced by an estimated $13 million, so your Sumter Property Tax will go down. The question is: will the reduction in Sumter Property Tax cancel out the amount you will pay the District?

Almost. VPSD estimates the taxes for people living in villas, ranch homes and designer homes will increase by $20 to $100 a year.

Why will they go up at all? If our taxes are simply sent to the District instead of Sumter County, shouldn't we pay the same amount?

That would seem logical, but it's not quite that simple as these nitty-gritty details explain. Warning: The explanation is math-based.

Forget averages! How much will MY taxes increase?

We cannot give you a specific answer because there are two variables that are unknown at this time:

- How much will Sumter decrease its millage rate?

- Will the District exercise the option of taxing us more than the standard annual assessment? And if so, how much?

If you provide your best guess to these two unanswered questions along with the Market Value, Taxable Value and Land Value of your home, we will email you the estimated tax increase within 24 hours. Our Best Guess Estimator will do the math for you and we will help you find the information you need.

Rumor Central

The League neither supports nor opposes the referendum. However, we are concerned about misrepresentation of the facts that are circulating and want voters to be aware of the following false or misleading statements. .

- The initial five-member Board of the Fire District is appointed by the Governor. They can raise our Fire Taxes, make long term agreements with the Developer, borrow millions or issue bonds, etc. What if they raise our Fire Taxes 25%? There is nothing we can do about it.

- A $124 flat fee per parcel is totally unfair to homeowners when commercial properties are paying the same fee.

- A 0.75 mil on improvements on your property, which is your Market Value minus Land Value is also unfair to homeowners because commercial properties have much higher land value, therefore their deduction from the Market Value is much higher, lowering their tax burden and in turn increasing the tax burden on homeowners.

- The County should ideally reduce our taxes by the amount of increase in taxes in the Fire District, but they are not doing it.

To learn the facts, click HERE

For additional information on the referendum as well as the three Florida Amendments and the candidates on the ballot, check out our online voter guide: Vote411